Last updated 5 months ago

Safe & Trusted OTC Trading with Reputation on Cardano

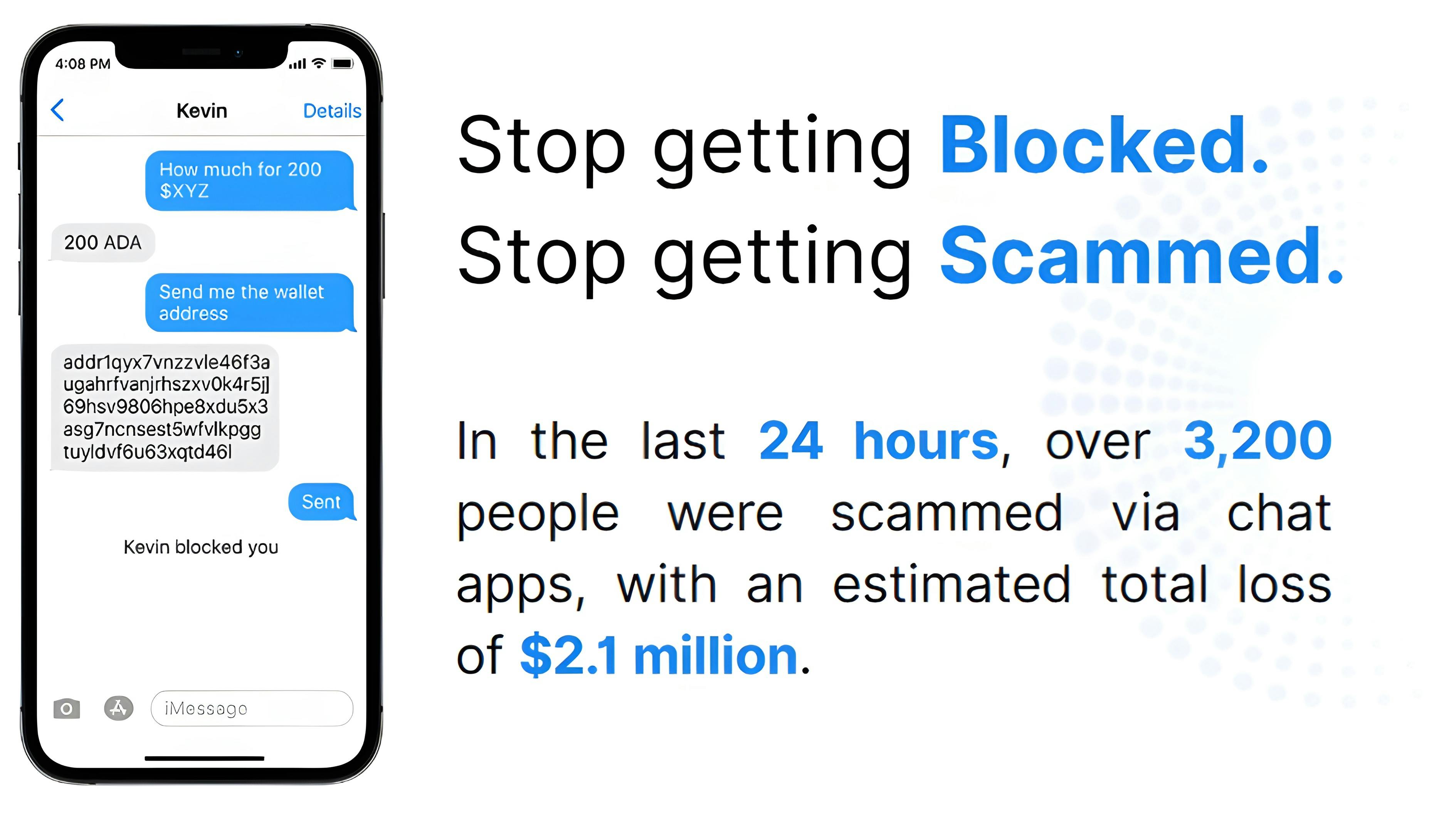

Problem

Most Cardano OTC trades happen in unverified chats, leading to scams, disputes, and lost trust. No shared identity, escrow, or reputation system exists to protect traders and communities.

Solution

We’ll build Reputa Market - a decentralized OTC platform with smart contract escrow, trader profiles, and human-verified reputation to make Cardano trades safe, transparent, and trust-driven.

Total to date

This is the total amount allocated to Safe & Trusted OTC Trading with Reputation on Cardano.

About this idea

[Proposal setup] Proposal title

Please provide your proposal title

Safe & Trusted OTC Trading with Reputation on Cardano

[Proposal Summary] Budget Information

Enter the amount of funding you are requesting in ADA

100000

[Proposal Summary] Time

Please specify how many months you expect your project to last

6

[Proposal Summary] Problem Statement

What is the problem you want to solve?

Most Cardano OTC trades happen in unverified chats, leading to scams, disputes, and lost trust. No shared identity, escrow, or reputation system exists to protect traders and communities.

[Proposal Summary] Supporting Documentation

Supporting links

- https://www.builderbase.org/ ,

- https://github.com/builderbaseorg/Reputa-Market ,

- https://reputadocs.vercel.app/

[Proposal Summary] Project Dependencies

Does your project have any dependencies on other organizations, technical or otherwise?

No

Describe any dependencies or write 'No dependencies'

No dependencies

[Proposal Summary] Project Open Source

Will your project's outputs be fully open source?

Yes

License and Additional Information

Reputa Market will be fully open source under the MIT License. All frontend, backend, and Plutus smart contracts will be published in public repositories, with verifiable on-chain artifacts (validator CBOR, script hashes, policy IDs). We provide reproducible build manifests so anyone can rebuild identical binaries. Documentation, API specs, and release notes will be openly available.

[Theme Selection] Theme

Please choose the most relevant theme and tag related to the outcomes of your proposal.

Payments

[Campaign Category] Category Questions

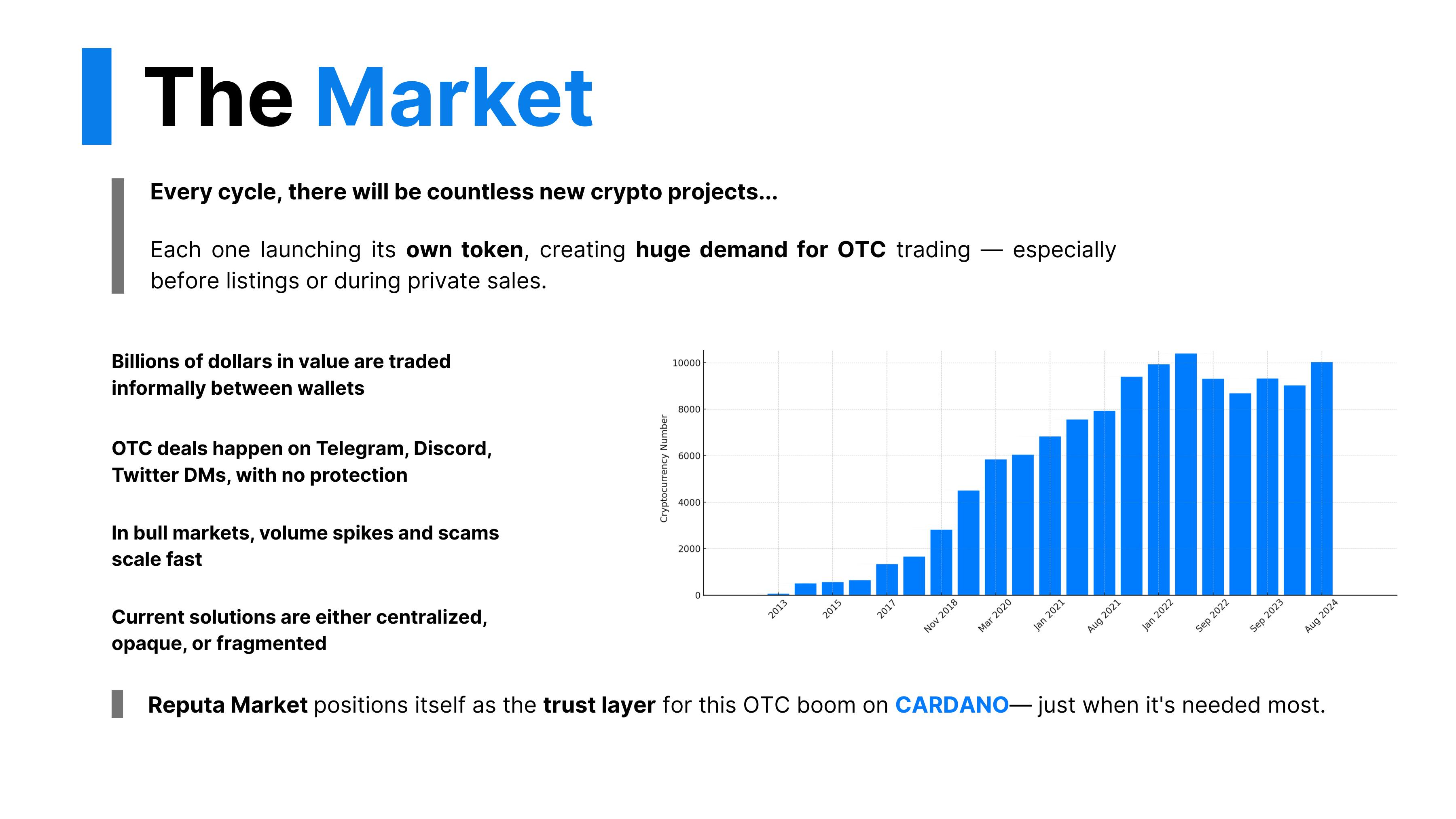

Describe what makes your idea innovative compared to what has been previously funded (whether by you or others).

Reputa Market is the first Cardano-native OTC platform to combine smart contract escrow, persistent on-chain trader profiles, and a human-verified reputation engine. Unlike prior funded projects focused on DEXs or generic marketplaces, Reputa targets the high-risk, unmoderated OTC space where scams thrive. Every trade is escrowed, every profile is public, and trust is earned, not bought. This identity-driven approach transforms OTC from “trust me” chats into a transparent, secure market layer.

Describe what your prototype or MVP will demonstrate, and where it can be accessed.

Our MVP lets anyone try safe OTC trading on Cardano testnet. You can browse live token listings, check seller reputations, start a trade through smart contract escrow, and leave reviews after completion. It also showcases real-time filters, dispute resolution, and Verified Seller badges. The demo will be open at reputamarket.io (testnet), with guides and open contracts so the community can test, break, and help improve it before mainnet launch.

Describe realistic measures of success, ideally with on-chain metrics.

**Success will be measured through verifiable on-chain activity and transparent user metrics. **

Targets for the first 90 days post-mainnet:

- Onboard 1,000–1,400 connected wallets

- Complete 200–500 on-chain escrows

- Achieve 50k–100k ADA in OTC volume

- Verify 15+ sellers under the 10-trade rule

- Maintain dispute rate <2.5%, resolve in <24h median

- Generate ≥30% of activations via referrals

- Publish all trade, dispute, and profile events on a public dashboard

[Your Project and Solution] Solution

Please describe your proposed solution and how it addresses the problem

Reputa Market - Product

What it is

Reputa Market is a Cardano-native OTC trading platform that turns risky chat deals into safe, verifiable trades. Every deal goes through a smart contract escrow, every wallet has a persistent public identity, and sellers can move a chat conversation into escrow with a single link. The familiar social flow stays the same. The “send first” risk is removed.

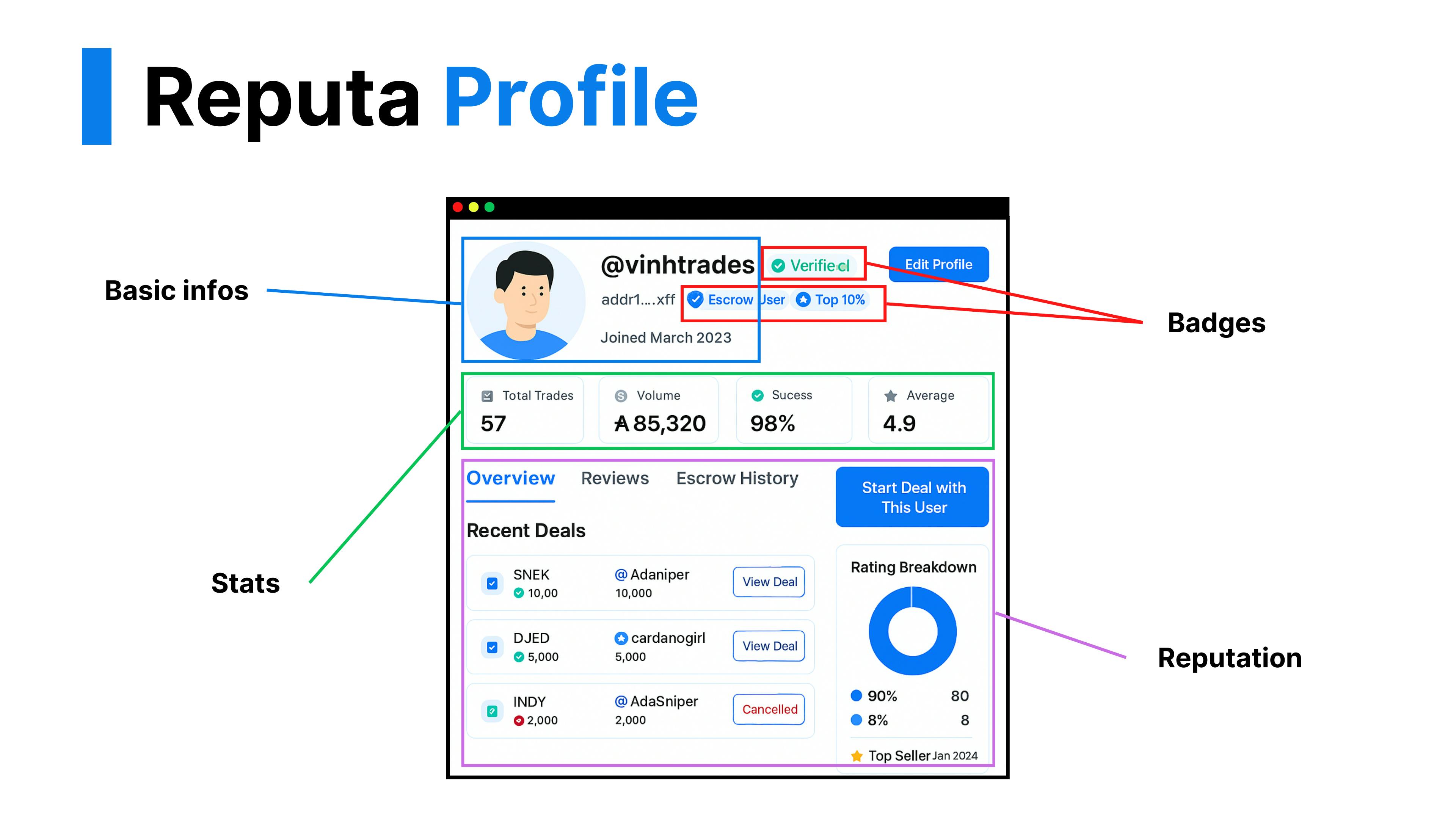

ReputaProfile: your trading identity

ReputaProfile is the core of Reputa. The moment a wallet connects, a profile is created that grows with real activity.

- Public identity: avatar, handle, short bio, optional socials verified by message signing.

- Trade history: completed deals with time, size, counterparties, and on-chain tx links.

- Ratings and reviews: 1 to 5 stars with short comments. Reviews are stored off-chain with integrity hashes that can be verified.

- Trust signals: badges such as Verified Seller, Escrow Compliant, and Top Seller.

- Time-weighted reputation: recent trades matter more than old ones to surface current behavior.

- Verified Seller: requires 10 successful trades and 0 unresolved disputes. Optional collateral support. Status can be revoked if disputes accrue.

- Wallet rotation: migrate a profile by two-way signing from old and new wallets with a 7-day cooldown. Migration history is permanent to prevent laundering.

How it fixes the problem

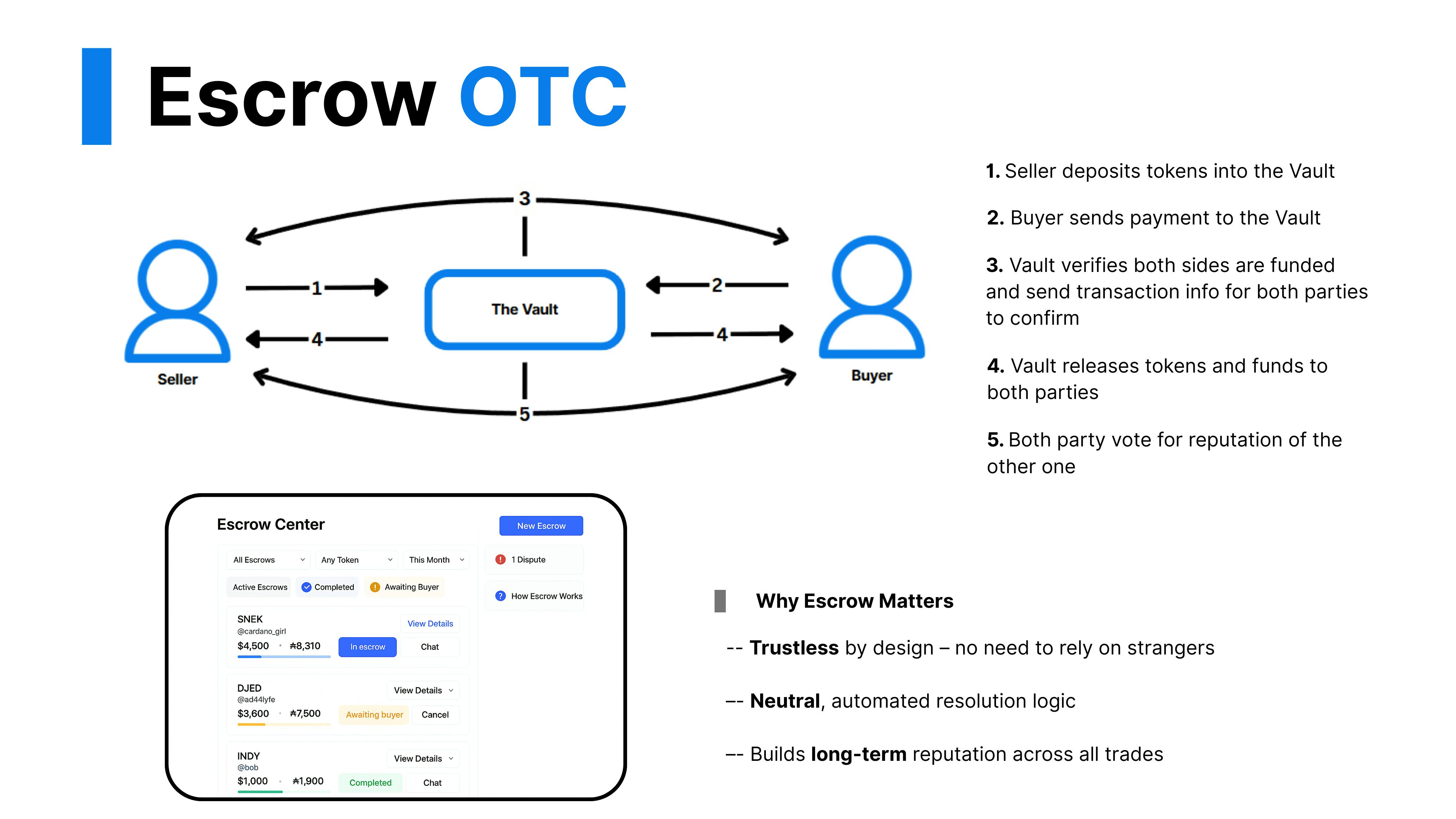

- Escrow by default: every deal uses The Vault (Plutus smart contract). Both sides lock funds. Settlement is atomic. No one sends first.

- Identity that compounds: profiles cannot hide past behavior. Good actors accumulate proof of trust.

- Chat → Link → Escrow: a seller creates a Direct Deal link with preset terms, drops it into Telegram or Discord, and both parties complete in minutes with full visibility of identity and reputation.

Concrete example

Alice wants to sell 50,000 XYZ. She clicks Start Direct Deal and gets a link. She shares it in Telegram. Bob opens it, sees Alice’s ReputaProfile, the prefilled terms, and the fee summary. Alice deposits tokens to The Vault. Bob deposits ADA. Both confirm. The Vault settles. Each leaves a short review that updates their profiles automatically.

User experience

- Getting started

- Connect with any CIP-30 wallet. ReputaProfile is created automatically with avatar, bio, optional socials, and zero ratings. No passwords. No custodial accounts.

- Seller flows

- Public listing (market mode): choose token, price in ADA for MVP, and amount. The listing appears on Marketplace with rating, badges, and deal size. Buyers filter by token, price, Verified sellers, or Most trusted.

- Direct Deal: create a private, prefilled escrow and get a shareable link. Paste the link in chat. The buyer lands on your deal with your profile visible. You deposit tokens to The Vault, the buyer deposits ADA, then both confirm.

- Buyer flow

- Open a shared link or browse Marketplace. See a seller snapshot with stars, recent trades, badges, and socials. Click Start Deal, fund your side, confirm, and receive tokens at settlement. Leave a review that becomes part of public history.

- Escrow, status, and failure behavior

- Statuses include Awaiting Buyer, In Progress, Completed, Disputed, Canceled. Each escrow has an on-chain transaction hash. If either party goes silent, timeouts trigger auto-dispute or refunds by policy, so funds do not get stuck. Outcomes such as split or return are enforced by the contract and recorded for accountability. Moderators can resolve escalations with transparent results that remain on profiles.

- Reputation that compounds

- Post-trade reviews update scores automatically. Time weighting favors recent activity. Communities can filter Verified only to avoid unknown sellers. Reputation is earned and can be revoked for bad behavior.

- Disputes without chaos

- Either party can Raise Dispute. The Vault enforces service-level timers and auto-dispute logic. Moderators resolve with clear outcomes. The record stays on the profile so future buyers can see what happened.

- Public verifiability in the UI

- Profiles and escrows link directly to on-chain tx hashes, validator or policy IDs, and release artifacts. Claims are checkable from the interface. Trust is auditable, not performative.

- Dashboards

- Marketplace: real-time listings with trust filters and pricing.

- Escrow Center: all live and past deals with statuses and actions.

- My Profile: avatar, bio, socials, ratings, badges, migration log, and trade stats.Mobile friendly. English and Vietnamese at launch.

- Privacy by design

- No PII is written on-chain. Review text is stored off-chain with integrity hashes. Socials are optional and verified by signing.

- Non-custodial guarantee

- Reputa never holds keys or funds. Assets lock temporarily in The Vault until atomic settlement or policy-driven refunds. Cancellations before both sides fund are free. Price and amount are locked when a deal is created.

- Open source and reproducibility

- Code is MIT-licensed. Validator CBOR, hashes, and build manifests are public so anyone can rebuild and verify.

- Fees and incentives

- MVP is fee-less to seed trust and adoption. Future options may include a small escrow fee, an optional Pro subscription for analytics and boosted listings, paid listing promotions, and partner token integrations. Verification is earned and never purchasable.

Bottom line

Reputa takes the way traders already operate in chat and adds identity, escrow, and reputation. A DM becomes a one-click, on-chain escrow with public accountability. The experience stays fast. The risk goes away.

[Your Project and Solution] Impact

Please define the positive impact your project will have on the wider Cardano community

Impact on the Cardano community

Reputa Market equips Cardano with an escrow-first, reputation-driven OTC layer that turns informal chat deals into auditable, low-risk transactions. Built by a team with direct trading and moderation experience, it is delivered under MIT with reproducible builds, published artifacts, clear dispute SLAs, and public metrics. This section outlines the expected impact on users and communities and the delivery standards we will be accountable to.

Reduce scam friction and loss

- Moves OTC trading from risky chats to escrow-by-default flows.

- Expect lower dispute rates and faster resolutions, with outcomes recorded for community visibility.

Keep users and liquidity on Cardano

- Gives traders and projects a safe place to buy-sell before or without CEX listings.

- Verified Sellers can build reputations that attract repeat business instead of pushing activity to other chains.

Make identity useful in practice

- Real usage of CIP-30 and CIP-68 for portable trader profiles.

- Reviews and dispute records create a shared memory the community can rely on when choosing counterparties.

Strengthen community norms

- Escrow first, proof second becomes the default behavior.

- Public profiles and badges reward good actors and make bad behavior visible.

Open-source building blocks for others

- MIT-licensed contracts, backend, and web app enable wallets, communities, and devs to reuse components for escrowed swaps, marketplace modules, and profile layers.

- Reproducible builds and published artifacts raise the bar for auditability across the ecosystem.

Support projects and grassroots tokens

- Safer distribution to early supporters, private allocations, and community raises.

- Auto-expiring listings and transparent pricing reduce confusion and spam.

Better moderation with transparency

- Clear dispute SLAs and on-chain references help mods resolve issues without drama.

- Outcomes are visible and feed back into reputation so lessons stick.

Real data for researchers and tooling

- Public dashboard and on-chain events let analysts, bots, and explorers surface trust signals, seller leaderboards, and market health in near real time.

Inclusive from day one

- English and Vietnamese at launch to serve large segments of Cardano’s user base.

Enables future integrations

- Reputa Profiles can anchor DAO credentials, NFT verifications, and identity-aware DeFi scores later, compounding utility across dApps.

How impact is measured and verified

- On-chain and product metrics published monthly: connected wallets, completed escrows, dispute rate and median resolution time, OTA volume in ADA, and count of Verified Sellers.

- All smart contract hashes, policy IDs, and build manifests are public so the community can verify behavior rather than trust claims.

Why this matters

We want this as badly as our users do. We’ve been the traders who got ghosted, the sellers buried in screenshots, and the mods trying to untangle he-said-she-said with no tools. That’s why we’re building Reputa the way we’d want to use it: escrow-first, profiles that remember, and open source under MIT with verifiable artifacts. We’ll run a public bug bounty, share transparent reports, and keep verification earned - not sold. We’re doing this with the community because we need it ourselves and we don’t want anyone on Cardano to go through those burns again.

[Your Project and Solution] Capabilities & Feasibility

What is your capability to deliver your project with high levels of trust and accountability? How do you intend to validate if your approach is feasible?

We’re set up to deliver fast and safely: a winning Cardano hackathon engineer leading Aiken/Plutus contracts, a PM with a deep university builder network, a seasoned legal lead for policy and dispute SLAs, and a BD/finance lead with multi-million-dollar raises. The architecture is simple and auditable (Aiken → Plutus v2, Next.js + FastAPI), shipped MIT-open with reproducible builds and public artifacts. Execution is milestone-gated on testnet, validated by community pilots, and tracked with transparent, verifiable metrics.

Team fit

- Legal representative and consultant – Phuong Diep Nguyen. Hanoi Law University 2008. Director at Authentik Vietnam Travel with ~10M USD annual revenue and 100 staff. Brings commercial discipline, contracts, ToS and dispute-policy drafting, and risk controls.

- Lead engineer – Dinh Quang Vinh. Winner, Cardano Blockchain Hackathon Vietnam 2025. Gold medalist, Hong Kong Computational Olympiad. Leads Aiken/Plutus contracts and the escrow state machine.

- Project manager – Minh Le. VP, Blockchain Student Pioneer Club. Organizer of Cardano Blockchain Hackathon Vietnam 2025. Operates delivery cadence, QA gates, and community testing. Strong network across top Hanoi universities for rapid staffing.

- Finance, partnerships – Tran Ly Huynh. Incubated projects that raised millions: Hyra Network 4.9M USD, U2U Network 13.8M USD. Owns budget control, go-to-market, and ecosystem partnerships.

Why we can deliver

- Clear, proven architecture. Smart contracts in Aiken compiled to Plutus v2; escrow state machine with explicit Fund -> Deliver -> Settle paths and Dispute outcomes. Web app in Next.js + Tailwind; API in FastAPI with PostgreSQL; IPFS for objects; Blockfrost for bootstrap with an Ogmios + Kupo self-hosted path as fallback. This mirrors what we already documented and can execute.

- Open, testable code. MIT license, public repos, validator CBOR and script hashes published, deterministic build manifests so anyone can reproduce binaries.

- Security and QA pipeline. Aiken unit tests plus property-based invariants to prevent stuck funds and enforce unlock paths. Playwright E2E for wallet connect, escrow, and reviews. k6 or Locust for API load. Chaos tests for delayed webhooks and burst disputes. Public bug bounty at MVP.

- Operational maturity. CI with typecheck, lint, tests, and Aiken compile gates. Sentry, Prometheus + Grafana, and uptime checks. Daily DB backups and restore drills. Secrets via OIDC to a cloud secret manager.

- Legal and policy coverage. Clear ToS, dispute SLAs, moderator policy, and privacy terms prepared by our legal lead. No PII on-chain. Off-chain reviews with integrity hashes.

Feasibility plan and validation

- Milestone gating.

- Design complete with contract specs and sequence diagrams.

- Testnet MVP: marketplace listings, profile creation, escrow happy path, post-trade reviews.

- Community hardening: disputes, moderator tooling, Verified Seller rule, auto-expire listings.

- Mainnet cut with stabilization fixes.

- User validation. Public testnet at reputamarket.io with step-by-step guides. Open Postman collection and OpenAPI spec. We will invite OTC communities and student clubs for structured testing sessions and publish findings.

- Measurable proof. Public dashboard that reports connected wallets, completed escrows, dispute rate and median resolution time, ADA volume, and count of Verified Sellers. Weekly snapshots and a 30-day launch report.

- Dependency fallback. If Blockfrost throttles, we switch to self-hosted Ogmios + Kupo via an adapter layer without app changes. If IPFS pinning provider degrades, we have a secondary pin set and can self-pin.

- Recruiting capacity. Through the PM’s university network and TARN LABS’ network of trust worthy builders, we can spin up additional frontend or QA contributors quickly for burst phases without slipping deadlines.

Risks and mitigations

- Adoption risk. Mitigate by seeding supply with Verified Seller onboarding and by keeping MVP fee-less. Marketplace plus later Direct Deal link keeps the chat-native flow users want.

- Smart contract bugs. Mitigate through property-based tests, reproducible builds, and public bounty before mainnet. Contracts are minimal and auditable.

- Dispute abuse or collusion. Mitigate with timeouts, moderator tools, transparent outcomes that affect reputation, and time-weighted scoring so recent, diverse counterparties matter more.

- Indexing or infra instability. Dual path for chain reads, health checks, and graceful degradation in the UI.

Accountability

- Transparency by default. Code, artifacts, and dashboards are public. We publish monthly reports that compare actuals to targets and explain gaps and fixes.

- Verification remains earned. 10 successful trades and 0 unresolved disputes, with automatic revocation on policy breaches. This keeps incentives aligned with community safety.

- Budget discipline. PM and finance lead run burn-down and velocity reviews each sprint; scope changes are logged and communicated in public updates.

Bottom line

This team blends on-chain engineering, product delivery, legal clarity, and partnerships. The system design is simple, auditable, and already specified. Our validation plan is public by design: open repos, reproducible builds, a testnet users can try, and metrics the community can verify.

[Milestones] Project Milestones

Milestone Title

Research & System Design

Milestone Outputs

- Architecture Pack: on-chain and off-chain boundaries, state diagrams, data flows.

- Escrow Spec: Aiken contract pseudocode and state machine, dispute policy, datum and redeemer schema.

- UX Wireframes: Marketplace, Escrow Center, My Profile, Direct Deal.

- Deploy Plan: environments, keys and secrets plan, release checklist.

Acceptance Criteria

- Output 1 is at least 6 pages and includes components, sequence diagrams, and failure modes.

- Output 2 defines the states Fund, Deliver, Settle, Dispute with unlock rules and includes sample datums and redeemers.

- Output 3 covers all core flows and mobile breakpoints and is reviewed by the team with comments resolved.

- Output 4 lists CI jobs, tagging, and a pre-mainnet checklist with success criteria.

Evidence of Completion

- Link to Architecture Pack as a PDF.

- Link to Escrow Spec in a public repo or PDF.

- Figma link for UX Wireframes with public view.

- Deploy Plan as a PDF shared with the proposal.

Delivery Month

1

Cost

11250

Progress

20 %

Milestone Title

MVP Development (Testnet)

Milestone Outputs

- Marketplace MVP: live filtering, seller previews.

- ReputaProfile v1: history, ratings, badges, verified socials.

- Escrow on Testnet: The Vault with basic dispute logic.

- Reviews Module: 1–5 stars and comments with integrity hashes.

- Wallet Integration: CIP-30 flows for connect, sign, submit.

Acceptance Criteria

- Output 1 lists, filters, and opens a listing detail without errors.

- Output 2 shows trade history with on-chain links and prevents manual edits.

- Output 3 completes end-to-end on testnet with P95 flow ≤ 2 minutes.

- Output 4 stores review bodies off-chain and anchors a hash; profile score updates immediately.

- Output 5 works with at least 3 wallets and handles disconnect and retry.

Evidence of Completion

- Public testnet URL with wallet login enabled.

- GitHub release with testnet addresses and CBOR files.

- Short video showing listing → escrow → settlement.

- QA sheet listing tests passed; ≥ 80% MVP coverage.

Delivery Month

3

Cost

30000

Progress

50 %

Milestone Title

Testing, Community Launch & Hardening

Milestone Outputs

- Public Testnet Demo with seeded listings and scripted trades.

- Verified Seller Pilot with onboarding guide and criteria.

- Bug-bounty Run with triage and fixes.

- Edge-case Suite covering timeouts, cancels, and refunds.

- Release Candidate Tag for contracts and app.

Acceptance Criteria

- Output 1 supports at least 50 external tester sessions without critical errors.

- Output 2 onboards at least 10 verified sellers meeting 10 successful trades and 0 unresolved disputes.

- Output 3 closes all high and critical issues; total bugs closed ≥ 25.

- Output 4 proves no stuck-fund paths and correct refund splits.

- Output 5 publishes v0.9-rc with validator CBOR, hashes, datum and redeemer schema.

Evidence of Completion

- Public demo link and a calendar of sessions.

- Spreadsheet (.xlsx) with verified sellers and criteria checks.

- Bug-bounty report (PDF) with counts by severity and links to fixes.

- Test log or table showing each edge case and pass result.

- GitHub release link to v0.9-rc and IPFS hash of artifacts.

Delivery Month

4

Cost

18750

Progress

70 %

Milestone Title

Mainnet Launch & Marketing

Milestone Outputs

- Mainnet Deploy of contracts and app.

- Token Integrations for ADA, one stablecoin, and 2 native tokens.

- DAO Moderation live with SOPs and SLAs.

- Launch Campaigns including referral program and two AMAs.

- D30 Metrics Report with growth and quality KPIs.

Acceptance Criteria

- Output 1 publishes addresses, CBOR, and checksums with a release note.

- Output 2 executes real trades for each integrated asset and records tx links.

- Output 3 proves moderator SLA: 95% flags reviewed within 12h, 100% within 24h.

- Output 4 spends ≤ ₳12,500 in D30 and achieves CAC per activated trader ≤ ₳31.25.

- Output 5 hits D30 targets: 600–1,000 connected wallets, 100–200 completed escrows, dispute rate ≤ 3%, median dispute resolution ≤ 24h, P95 escrow flow ≤ 2 minutes.

Evidence of Completion

- Public mainnet URL and GitHub release with artifacts.

- Screenshots or explorer links for successful mainnet escrows and disputes.

- DAO moderator SOP PDF and SLA dashboard screenshot.

- Marketing report PDF with funnel, CAC by channel, and spend.

- Metrics export (CSV or screenshots) for D30 KPIs.

Delivery Month

5

Cost

30000

Progress

90 %

Milestone Title

Final Report & Documentation

Milestone Outputs

- Technical Docs for frontend, backend, and Aiken contracts.

- Public API Spec with OpenAPI JSON and Postman collection.

- Reproducible Build Manifest with compiler versions and dependency hashes.

- User Docs and Tutorial Video showing wallet connect to settlement.

- Final KPI Report with lessons and next-steps plan.

- Tagged Public Repos for all components.

Acceptance Criteria

- Output 1 covers setup, deploy, and ops runbooks end to end and is at least 12 pages.

- Output 2 is tested against the live API and includes curl examples.

- Output 3 reproduces identical hashes from source.

- Output 4 demonstrates a full mainnet trade in ≤ 3 minutes.

- Output 5 includes D30 and cumulative D90 KPIs with comparison to targets.

- Output 6 tags a final release with artifact hashes.

Evidence of Completion

- Docs site link and downloadable PDF.

- OpenAPI URL or JSON and Postman collection link.

- Build manifest PDF and verification note.

- Tutorial video link.

- KPI export (CSV) and summary PDF.

- GitHub links to tagged releases.

Delivery Month

6

Cost

10000

Progress

100 %

[Final Pitch] Budget & Costs

Please provide a cost breakdown of the proposed work and resources

Total requested: 100,000 ADA (planned at $0.80 per ADA ≈ $80,000). All planning and disbursement is in ADA.

Budget summary by category (ADA):

- Team Compensation: 50,100 ADA. Core build across frontend, backend, Aiken contracts, UI/UX, QA/PM.

- Infrastructure and Tooling: 8,300 ADA. Hosting, database, IPFS, node and indexer access, monitoring, CI and security tooling.

- Marketing and Community Growth: 27,500 ADA. Launch campaigns, PR, placements, creative, and attribution tools around mainnet.

- Community Incentives and Events: 7,550 ADA. Bug bounties, trader contests, verified seller gas grants, Discord or Telegram events.

- Contingency Reserve: 6,550 ADA. Buffer for price or usage variance, released only if needed.

Team compensation detail (roles • hours • rate → ADA):

- Full stack Developer: 280 hours × $66.80 → 23,380 ADADeliverables: marketplace, profile, wallet flows, API integration, performance hardening.

- Smart Contract Engineer: 200 hours × $66.80 → 16,700 ADADeliverables: escrow and dispute state machine in Aiken to Plutus v2, tests, release artifacts.

- UI and UX Designer: 60 hours × $53.44 → 4,008 ADADeliverables: marketplace and escrow UX, responsive components, design system, Figma files.

- QA and Project Manager: 90 hours × $53.44 → 6,012 ADADeliverables: test plans for unit and end to end, issue triage, release coordination, KPI reporting.Subtotal: 50,100 ADA.

Infrastructure and tooling detail (ADA):

- Web hosting and edge plus domains: 1,200 ADA

- API or workers compute plus Redis: 2,400 ADA

- Managed PostgreSQL: 1,600 ADA

- Node or indexer access with Blockfrost: 1,100 ADA

- IPFS pinning: 700 ADA

- Monitoring and alerts with Sentry, Healthchecks, Grafana or Prometheus: 500 ADA

- Security and CI credits for SAST, dependency scans, and GitHub Actions minutes: 800 ADASubtotal: 8,300 ADA.

Marketing and community growth detail (ADA):

- Airdrop and referral campaigns: 6,700 ADA (goal: verified seller growth and first trade activation).

- Social marketing and ads on X and niche crypto media: 5,000 ADA (CTR and CAC tracked in PostHog).

- Part time content and community manager for 6 to 8 weeks: 2,500 ADA

- KOL or Spaces collaborations: 1,700 ADA (co-hosted demos and Q and A).

- Design assets and product video: 1,600 ADA (launch visuals and short explainer).

- PR and launch push: 3,750 ADA (press kit and distribution to crypto outlets).

- Product Hunt or Launch Week placements: 3,125 ADA

- Attribution and analytics tools: 1,250 ADA

- Ambassador micro grants: 1,875 ADASubtotal: 27,500 ADA.

Community incentives and events detail (ADA):

- Bug bounty program: 3,300 ADA (on chain behavior and web app exploits).

- OTC trader contests: 1,700 ADA (rewards to seed activity by volume and quality).

- Verified seller gas or ADA grants for about 100 users: 850 ADA

- Discord or Telegram events and rewards: 1,700 ADASubtotal: 7,550 ADA.

Contingency and control: 6,550 ADA

Used only for price or usage variance or critical fixes. Any draw of 1,000 ADA or more will be disclosed in the monthly update with purpose, amount, and impact. If unused, it remains unspent.

Total: 100,000 ADA

Cost control levers and swap outs:

- Swap providers when economical: Blockfrost to self hosted Ogmios + Kupo, managed Postgres to self managed Postgres on Hetzner with pgBackRest, PostHog Cloud to self hosted PostHog or Umami if usage spikes.

- Right size infrastructure: autoscale API or worker instances, archive logs, tune database retention, prune IPFS pins with lifecycle policies.

- Apply scope guardrails: if marketing CPM or CPA inflates, shift budget toward ambassador and referral programs with capped payouts.

Pricing caution and stability policy:

Service pricing and usage based costs can change over time for compute, storage, APIs, and ad inventory. ADA to USD can also move relative to the $0.80 planning rate. We will actively manage vendors, scale resources, and apply the swap outs above to keep actual spend as close to this ADA budget as possible. Any variance and rebalancing will be reported in monthly updates. Deliverables remain as scoped within the 100,000 ADA total.

[Final Pitch] Value for Money

How does the cost of the project represent value for the Cardano ecosystem?

Why this is good value for Cardano: Reputa Market delivers a working, open on-chain OTC layer in six months, with reusable Aiken contracts, a human verified reputation engine, and public documentation that other Cardano builders can adopt. The budget is milestone tied, no tranche above 30,000 ADA, and each release has clear acceptance criteria and evidence. Funding creates durable infrastructure that reduces scams, improves user confidence, and keeps trading activity inside the Cardano ecosystem.

Concrete outputs for the budget

- Mainnet ready escrow and dispute state machine in Aiken to Plutus v2, with validator CBOR, script hashes, datum and redeemer schema, and a reproducible build manifest.

- Production web app and API with CIP-30 wallet flows, marketplace listings, ratings and reviews, Verified Seller logic, and DAO backed moderation.

- Public API spec and Postman collection, full developer and user documentation, and a tutorial video that shows wallet connect to escrow to settlement on mainnet.

- Analytics and attribution setup that reports connected wallets, activated traders, completed escrows, dispute rate and time to resolution, and channel level CAC.

Efficient team cost

- Total team cost is 50,100 ADA which equals about 630 hours at an average of roughly 63 USD per hour. This rate is below typical agency pricing while still paying professional contributors. Work is focused on a single scoped MVP, not on broad research, which increases output per ADA.

Milestone gating reduces risk

- Five milestones with fixed acceptance criteria and public evidence. Funds release only when outputs are delivered. No single milestone exceeds 30,000 ADA. This structure limits downside and keeps delivery on schedule.

Security and quality baked in

- Aiken unit tests and property based invariants target no stuck funds and correct unlock paths. Frontend E2E tests verify wallet flows. A standing bug bounty and a public release checklist improve quality without the cost of a third party audit.

Reusability for the ecosystem

- Escrow engine, dispute patterns, and profile NFT pointers using CIP-68 are designed to be copied by other Cardano projects. Publishing specs and artifacts lowers integration cost for the next team. One funded project, many downstream builders.

Growth efficiency and measurable ROI

- Marketing and community budget is 27,500 ADA for the whole project with a first 30 day cap of about 12,500 ADA. Target CAC in the first month is about 31.25 ADA per activated trader at the planned $0.80 rate. With 600 to 1,000 connected wallets and 100 to 200 completed escrows in the first 30 days, the spend converts directly into on chain activity and reputation growth.

Lean infrastructure with swap out options

- Provider choices keep costs low and can be replaced if usage spikes. Blockfrost can be swapped to self hosted Ogmios and Kupo. Managed Postgres can move to self hosted with pgBackRest. PostHog Cloud can shift to self hosted PostHog or Umami. These levers protect the ADA budget while maintaining performance.

Sustainability after funding

- Post launch operations are modest. A small escrow fee or optional pro tools can cover hosting and maintenance. The platform does not rely on perpetual grants, so the initial investment creates a self sustaining service.

Direct ecosystem benefits

- Safer OTC trades mean fewer scam losses, faster circulation of native tokens, and higher user retention on Cardano. Verified sellers and public trade histories create a positive feedback loop where trust compiles over time.

[Required Acknowledgements] Consent & Confirmation

Terms and Conditions:

Yes

Team

Phuong Diep Nguyen – Legal and Advisor

- Background: Hanoi Law University (2008). Director of Authentik Vietnam Travel, managing ~$10M annual revenue and 100 employees.

- Responsibilities: Terms of Service, dispute & moderation policy, data/privacy compliance, contract templates, vendor compliance checks.

- Contact: phuongdiep.nsdj@gmail.com/phuongdiep@authentikvietnam.com

Dinh Quang Vinh – Lead Blockchain Engineer

- Background: Winner, Cardano Blockchain Hackathon Vietnam 2025. Gold medalist, Hong Kong Computational Olympiad.

- Responsibilities: System architecture, Aiken-to-Plutus v2 contracts, Lucid transaction building, code reviews, property-based testing, reproducible releases, mainnet deployment.

- Contact: x.com: vingdev ; telegram: @calvith ; dqv12908@gmail.com

Le Dinh Minh – Project & Community Manager

- Background: VP, Blockchain Student Pioneer Club. Organizer, Cardano Blockchain Hackathon Vietnam 2025. Strong network across top Hanoi universities.

- Responsibilities: Sprint planning, scope & risk management, QA coordination, Verified Seller program, moderator onboarding, community events, KPI tracking & reporting.

- Contact: x.com: @minh_tex ; telegram: @ledinhminh

Tran Ly Huynh – Growth and Partnerships Lead

- Background: Founder of TARN LABS. Led incubations that helped projects raise 4.9M USD (Hyra Network) and 13.8M USD (U2U Network).

- Responsibilities: Partner outreach, exchange and KOL relations, BD pipeline, growth budget execution, and marketing OKRs. Focus on Milestones 3 and 4 delivery quality.

- Contact: x.com: @huynhtarn ; telegram: @huynhtarn

- Note: This role operates as an individual contributor within the project team. The project does not rely on TARN LABS or any external entity for execution.

Core contributors (initial)

- UI and UX Designer: Figma design system, Tailwind and shadcn handoff, accessibility checks, responsive patterns for marketplace and escrow.

- QA Engineer: Test plans, E2E wallet flow automation, regression and load tests, bug bounty triage with engineering.

Capacity plan

We will add 1 to 2 pre vetted engineers in Month 2 for front end feature work and test automation. Additional contributors will be scoped to specific backlog items with measurable outputs and code ownership.