Last updated 4 months ago

One-Click Insurance for transactions onCardano Chain & DApps

Problem

Lack of a Retail focussed Insurance Solution in web3; let alone a micro insurance for any transaction on Cardano chain and DApps.

Solution

Insurance-On-The-Go for any transaction being done on blockchain; completely retail focussed; no annual Insurance premiums; Pay-as-you-Go; and cover against any possible web3 hack or exploit.

Total to date

This is the total amount allocated to One-Click Insurance for transactions onCardano Chain & DApps.

About this idea

[Proposal setup] Proposal title

Please provide your proposal title

One-Click Insurance for transactions onCardano Chain & DApps

[Proposal Summary] Budget Information

Enter the amount of funding you are requesting in ADA

500000

[Proposal Summary] Time

Please specify how many months you expect your project to last

9

[Proposal Summary] Translation Information

Please indicate if your proposal has been auto-translated

No

Original Language

en

[Proposal Summary] Problem Statement

What is the problem you want to solve?

Lack of a Retail focussed Insurance Solution in web3; let alone a micro insurance for any transaction on Cardano chain and DApps.

[Proposal Summary] Supporting Documentation

Supporting links

- https://docsend.com/view/wcbikywrzjja44me ,

- https://www.web3shield.com ,

- https://whitepaper.web3shield.com ,

- https://docs.web3shield.com ,

- https://drive.google.com/file/d/1nzmFpbAoTppWNJFc68eUYvFmmrBo-fFd/view?usp=sharing

[Proposal Summary] Project Dependencies

Does your project have any dependencies on other organizations, technical or otherwise?

No

Describe any dependencies or write 'No dependencies'

No dependencies

[Proposal Summary] Project Open Source

Will your project's outputs be fully open source?

Yes

License and Additional Information

Web3Shield is completely decentralized and a transparent product as an ideal Insurance solution is supposed to be. All Insurance Premiums, Claims, and Covers’ logic will be on-chain and 100% verifiable by anyone at any time.

[Theme Selection] Theme

Please choose the most relevant theme and tag related to the outcomes of your proposal

DeFi

[Campaign Category] Category Questions

Describe your established collaborations.

- Anzens (USDA Stablecoin) : Signed MoU to provide stablecoin depeg insurance on USDA, ensuring direct Cardano utility and demonstrates ecosystem alignment

- Ongoing discussions with existing Cardano Wallets and dApps: In active talks for pilot integrations, embedding one-click insurance in existing transaction flows

- Pre-Exisiting Softlaunch on Base Blockchain Testnet : Web3Shield is an already existing project that underwent a soft-launch on Base testnet to validate system readiness and optimize premium logic ahead of Cardano rollout. Link : base.web3shield.com

Describe funding commitments.

- Catalyst : Primary funding source, ₳500,000 request for 9-month roadmap.

- What will it Cover : Research, development, actuarial modeling, audits and integrations for Cardano Ecosystem.

- Beyond Catalyst : Engaging with ecosystem funds & strategic partners (wallets/dApps, etc.) for support and co-funding post-MVP.

- Self-Sustainability : Pay-as-you-Go model ensures self-sufficiency after launch, no ongoing grant reliance. Once Pay-as-you-Go model is live, transaction-based insurance premiums will fund ongoing operations and growth.

Describe your key performance metrics.

- Technical Delivery: Testnet contracts(M4), Risk Engine(M6), Mainnet beta + ≥2 dApp integrations(M9)| Proves functional delivery.

- Adoption Metrics: No. of Insured transactions, ADA value protected (Low (1%) : ₳936Mn | Medium(5%) : ₳4.68Bn | High(15%) : ₳14.04Bn annually)| Shows protection of user funds, grows ecosystem TVL and increase transaction count.

- Community and Ecosystem: ≥2 new ecosystem partners, bi-weekly updates, pilot surveys| Ensures trust and co-creation.

- Dashboards and Analytics: Public dashboards on txns, premiums and claims for transparency.

[Your Project and Solution] Solution

Please describe your proposed solution and how it addresses the problem

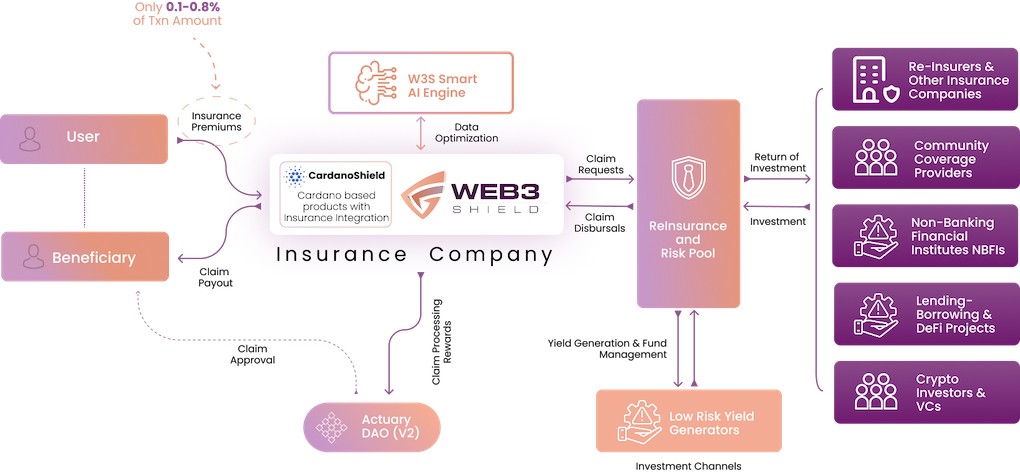

- Web3Shield operates as the Insurance Layer for Web3 offering On-The-Go Insurance for every possible on-chain transaction right at the time of transaction initiation. It includes but is not limited to oracles insurance, DEX insurance, stablecoin depeg insurance, wallet insurance, staking insurance, cross-chain bridging insurance, zk-insurance, restaking insurance, RWA insurance, etc.

- It is completely retail focussed and enables end users with the power of One-Click Insurance for all their transactions on-chain and be insured against any hacks or exploits, loss of funds, transaction delays, network congestions, transaction drops, etc. However the product can be offered via Institutions / Projects for their end customers.

- It operates with a Pay-as-you-Go model and hence no annual Insurance premiums are to be paid by the user. They can pay and get insurance right at the time of doing a transaction and be assured that their funds are safe and covered.

- In conclusion, Web3Shield is an Insurance Layer made up of a suite of insurance, privacy, artificial intelligence and security centric products with an aim to reimagine the insurance experience in Web3.

Business Operation Model Visual Image : https://drive.google.com/file/d/1nzmFpbAoTppWNJFc68eUYvFmmrBo-fFd/view?usp=sharing

Additional Notes :

- Web3Shield is not starting from scratch — it is an already existing project that underwent a soft-launch on Base testnet to validate system readiness and identify optimizations. This testnet deployment was time-gated and available only for a limited period, serving as a proof point before expanding to Cardano. The original/initial link to the same - https://base.web3shield.com

- Web3Shield, to show it's value and commitment to the Cardano ecosystem, has already reached an MOU with Anzens (Issuers of licensed USDA stablecoin in Cardano Blockchain). This partnership would offer Anzens' users protection against hacks or Depeg of USDA (further details or announcements will be out after the complete relevant tech review on both sides). More details mentioned in the proposal below. In addition we are in active conversations with some exciting Cardano ecosystem projects to integrate insurance in their working models, resulting in a paced-up initial growth and adoption.

- We have signed MNDA and MoU with one of the biggest web2 reinsurer as one of our reinsurance partners and provide insurance capacity (explicit details available if required legally)

- Already have an existing solution developed for Chainlink on top of their CCIP product ( https://chain.link/cross-chain ) that will be offered to Cardano Ecosystem.

[Your Project and Solution] Impact

Please define the positive impact your project will have on the wider Cardano community

Web3Shield is an already existing product with a sizable amount of work done and results achieved in terms of a strong insurance network creation (premiums, covers and claim payouts). The product, if being brought to Cardano ecosystem, will add a lot of value to this ecosystem as a whole, including but not limited to :

- Enabling One-Click Insurance on native Cardano products including Oracles, bridges, staking platforms, wallets, etc. In line with this, Web3Shield has signed an MoU with Anzens (issuer of USDA stablecoin) to provide stablecoin depeg insurance. This ensures Cardano users are protected against one of the most common DeFi risks.

- Increasing Cardano adoption by making the Cardano ecosystem risk-free and seamless for any web2/web3 user, as their funds are always covered.

- Reduces risk of impact of any black-swan events including rugs, exploits, hacks, tech-loopholes, etc.

- Web3Shield’s B2C solution empowers Cardano users to protect their transactions in real time. In addition, B2B solution with Wallet/dApp integrations will ensure ecosystem uptake.

- Increased on-chain transaction volume and protected ADA. Even if Web3Shield gets 1% adoption in the ecosystem, it will add approx 9.3 million on-chain transactions and could protect approx 936M in ADA annually (*detailed calculations in last section ‘Value for Money’)

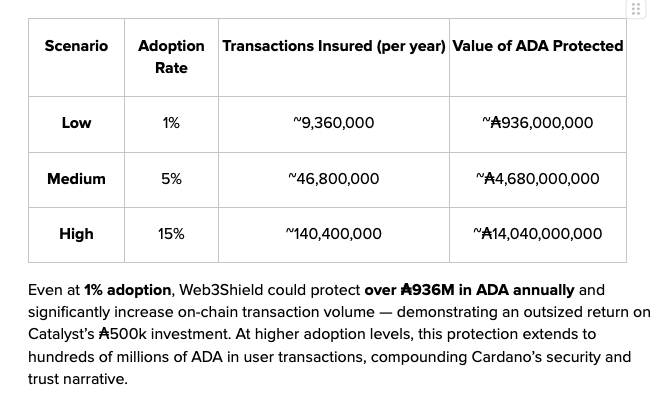

Scenario Visualisation : Cardano currently processes 2.6 million transactions daily (78M monthly) (in mid 2025 as reported by CoinLaw). Assuming an average transaction size of ₳100 and a Pay-as-you-Go insurance cost of just ₳0.01 per transaction:

Low Adoption | 1% adoption rate | ~9,360,000 Transactions Insured per Year | ~₳ 936,000,000 Value of ADA Protected

Medium Adoption | 5% adoption rate | ~46,800,000 Transactions Insured per Year | ~₳ 4,680,000,000 Value of ADA Protected

High Adoption | 15% adoption rate | ~140,400,000 Transactions Insured per Year | ~₳ 14,040,000,000 Value of ADA Protected

Even at 1% adoption, Web3Shield could protect over ₳936M in ADA annually and significantly increase on-chain transaction volume by multi-millions — demonstrating an outsized return on Catalyst’s ₳500k investment. At higher adoption levels, this protection extends to hundreds of millions of ADA in user transactions, compounding Cardano’s security and trust narrative.

[Your Project and Solution] Capabilities & Feasibility

What is your capability to deliver your project with high levels of trust and accountability? How do you intend to validate if your approach is feasible?

The capability is strong considering the following pointers -

- Existing Product : Since the product is already developed OR in advance development stages on other EVM chains, it makes it easier for the team to strategise and build the solution on Cardano. The previous soft-launch on Base blockchain serves as a proof point before expanding to Cardano.

- Team Expertise: Our core team includes individuals from web3, insurance, strategy and marketing domains and has a combined 35+ years of experience. The team also includes advisors from other reputed insurance and Web3 firms and have been SMEs in their respective domains. (*details of team members below in "Final Pitch>Project Team" section)

- Ecosystem Partnerships: Web3Shield has recently signed an MoU with Anzens, the issuer of USDA, one of the official Cardano stablecoins. Through this partnership, Web3Shield will offer stablecoin depeg insurance on USDA, providing immediate utility and protection to Cardano users against one of DeFi’s most critical risks. This demonstrates the ecosystem trust and alignment we have already achieved within Cardano. In addition, Web3Shield has an existing solution developed on Chainlink for their CCIP product that will be offered to Cardano Ecosystem.

- Transparent Development: We’ll publish open progress reports bi-weekly or monthly on GitHub and Cardano forums so the community can track milestones.

- Open-Source Components: Wherever possible, core insurance logic will be released under an open-source license for community audit.

- Community Co-Creation: We’ll work closely with Cardano dApp developers, SPOs, and wallet providers to ensure features meet real-world needs.

- Audit and External Validation: Before full launch, a comprehensive external audit will be conducted to make sure the product is fit for purpose.

In addition, the validation to our approach will be fulfilled by an incremental Phase-Build process including :

Phase 1 – Proof of Concept (Testnet)

Phase 2 – Controlled Pilot

Phase 3 – Measurable KPIs

Phase 4 – Community Verification

By progressing through these stages, we ensure technical feasibility, user adoption, and community trust before full ecosystem integration.

[Milestones] Project Milestones

Milestone Title

Research & Architecture Design

Milestone Outputs

- Conduct deep-dive research into Cardano on-chain transaction flows and insurance risk models.

- Define the cardano-specific architecture for the One-Click Insurance Creation and Integration.

- Identify supported transaction types for initial launch (Stablecoins, Oracles, Bridging, wallet transfers, staking, etc.).

Acceptance Criteria

- Completed architecture diagram for Web3Shield on Cardano.

- Risk and actuarial model documented for Pay-as-you-Go insurance.

- Defined transaction types for initial rollout (oracles, wallet transfers, staking, bridging, etc).

Evidence of Completion

- Publicly shared Technical Architecture Blueprint PDF in GitHub repo.

- Detailed insurance logic flow for Cardano-based transactions.

- Risk Model Document uploaded to GitHub / Catalyst update (open-source logic and numbers only).

Delivery Month

2

Cost

100000

Progress

20 %

Milestone Title

MVP Development (Core Insurance Layer)

Milestone Outputs

- Build the base Web3Shield blockchain and smart contract layer for policy creation and claims.

- Integrate with Cardano smart contracts and wallets for testnet.

- Implement Pay-as-you-Go payment logic.

Acceptance Criteria

- Deployed Web3Shield smart contracts on Cardano testnet.

- Policy creation and claim submission functions working on testnet.

- Multi-Wallet mockup with functional 1-click insurance flow.

- Pay-as-you-Go logic functional in test environment.

Evidence of Completion

- Cardano testnet contract addresses published.

- Demo video of policy issuance & claim process.

- Source code repository with smart contracts.

- Screenshots / Figma link of multiple wallet integration mockup.

Delivery Month

4

Cost

150000

Progress

50 %

Milestone Title

Risk & Pricing Engine + Additional RollOuts

Milestone Outputs

- Additional selected rollouts (insurance for other products not included in previous rollouts; selective considering network state)

- Multiple Cardano wallets support.

- Addition of assessment engine for network congestion, delays, and exploit patterns.

- Dynamic premium calculation per transaction.

Acceptance Criteria

- Real-time transaction risk scoring engine functional.

- Multi Wallet Support including 2 additional Cardano wallets.

- Premium calculated dynamically based on transaction risk profile.

- Congestion, network conditions & exploit detection APIs

Evidence of Completion

- API endpoint documentation for risk scoring.

- Sample output logs showing risk assessment & dynamic premium calculation.

- Internal testing report with detection accuracy metrics.

- Short demo video showing live premium calculation.

Delivery Month

6

Cost

150000

Progress

80 %

Milestone Title

Privacy & Security Enhancements

Milestone Outputs

- Harden Security with internal and external security audits along with well documented audit reports.

- Enhance Premium calculation logic and methodologies

- Enhanced fraud detection logic, optimizations of system for automating fraud detection.

Acceptance Criteria

- Completed internal and external security audits with well documented audit report.

- Updated Premium calculation logic and methodologies, wherever applicable.

- Updation of Fraud detection logic in the system, wherever feasible.

Evidence of Completion

- Audit report from third-party security firm.

- Documentation of optimized premium calculation process.

- Catalyst update post summarizing findings.

Delivery Month

7

Cost

50000

Progress

90 %

Milestone Title

Pilot Launch & Ecosystem Integration

Milestone Outputs

- Launch public beta for Cardano users.

- Partner with at least 2 Cardano dApps/ecosystem projects for integrated insurance coverage.

- Collect user feedback and refine products based on the feedback.

Acceptance Criteria

- Public beta live for Cardano mainnet users.

- At least two dApps or ecosystem projects partnerships and integrations.

- User feedback collected and documented.

- Updated roadmap prepared for the scaling phase.

Evidence of Completion

- Live mainnet dApp URL with active users.

- Integration confirmation letters/emails from partner dApps.

- User feedback survey results.

- Updated roadmap document shared publicly.

Delivery Month

9

Cost

50000

Progress

100 %

[Final Pitch] Budget & Costs

Please provide a cost breakdown of the proposed work and resources

1. Research and Architecture

Description : Cardano-specific architecture design, risk and actuarial models, transaction mapping

Cost in ADA : ₳75,000

2. Product Development and Engineering

Description : Core insurance smart contracts, wallet integrations, risk/pricing engine, premium model, front-end flows

Cost in ADA : ₳220,000

3. Actuarial Costs and Expenses

Description : Risk modelling, transaction risk scoring, premium calculations, fraud detection logic

Cost in ADA : ₳40,000

4. Security Audits

Description : Internal and external audits, penetration testing, optimization of fraud detection logic

Cost in ADA : ₳45,000

5. Infrastructure and Operations

Description : Hosting, APIs, oracles, data feeds, monitoring, ongoing devOps

Cost in ADA : ₳35,000

6. Community Engagement and Education

Description : Documentation, workshops, Catalyst town halls, developer onboarding, user adoption campaigns

Cost in ADA : ₳25,000

7. Business Development and Partnerships

Description : Partnership with dApps, wallets, SPOs, onboarding ecosystem players (including MoU executions etc.)

Cost in ADA : ₳30,000

8. Contingency and Risk Buffer

Description : ~6% allocation for unforeseen costs and initial risk pool costs

Cost in ADA : ₳30,000

[Final Pitch] Value for Money

How does the cost of the project represent value for the Cardano ecosystem?

The proposed budget directly funds the design, development, and deployment of Web3Shield’s on-chain One-Click Insurance Solution — a first-of-its-kind retail-focused protection service for Cardano transactions.

This investment creates ecosystem-wide value in several ways:

1. User Protection → Increased Trust & Adoption

- By enabling everyday users to insure transactions in real time (wallet transfers, staking, bridging, etc.), we significantly reduce losses from hacks, exploits, delays, or network failures.

- Higher confidence in using Cardano dApps leads to more active wallets, higher transaction volume, and stronger TVL (Total Value Locked) across DeFi.

2. Catalyst Leverage Effect

- Funding covers core development, risk modelling, AI risk engine, and ecosystem integrations — all of which will be open for community verification.

- Once deployed, Web3Shield can be monetized via the Pay-as-you-Go model without further dependency on Catalyst funding, ensuring long-term sustainability.

3. Ecosystem-wide Integration Potential

- Wallets, staking pools, DeFi protocols, NFT marketplaces, stablecoins and cross-chain bridges can integrate the insurance layer, directly benefiting their users and boosting Cardano’s competitiveness in Web3.

- Every user of Web3Shield will be eligible to generate their wallet’s trust score/ Insurance score that can be used for user’s onboarding and analysis by any other Cardano dApp ecosystem wide.

4. Value vs. Cost Efficiency

- Traditional insurance requires annual premiums and central intermediaries. Web3Shield operates with no annual premiums, just pay-as-you-go model.

- Web3Shield’s model eliminates intermediaries, allowing funds to be spent on product delivery, security audits, and integration partnerships rather than administrative overhead.

- The total budget delivers a retail-ready product in 9 months that could protect millions of ADA in user funds over its first year alone.

5. Alignment with Cardano’s Strategic Goals

- Supports Cardano’s vision of secure, decentralized financial infrastructure.

- Bridges a gap in user safety, encouraging adoption from both retail users and institutional participants hesitant to engage in DeFi without safety nets.

6. Security to Cardano Users

Protection to Cardano Users against any possible rug pull, major protocol exploit or hack. Multiple instances have been reported in the past with a lot of alleged cardano projects(names easily available on internet) failing, rugging, exploited, etc and users losing their ADA in them. Hence, Web3Shield can safeguard the users against any possible hack or project failure.

7. Increased On-Chain Transactions and ADA protected

Cardano currently processes ~2.6 million transactions daily (~78M monthly) (in mid 2025 as reported by CoinLaw). Assuming an average transaction size of ₳100 and a Pay-as-you-Go insurance cost of just ₳0.01 per transaction:

Low Adoption | 1% adoption rate | ~9,360,000 Transactions Insured per Year | ~₳ 936,000,000 Value of ADA Protected

Medium Adoption | 5% adoption rate | ~46,800,000 Transactions Insured per Year | ~₳ 4,680,000,000 Value of ADA Protected

High Adoption | 15% adoption rate | ~140,400,000 Transactions Insured per Year | ~₳ 14,040,000,000 Value of ADA Protected

Even at 1% adoption, Web3Shield could protect over ₳936M in ADA annually and significantly increase on-chain transaction volume — demonstrating an outsized return on Catalyst’s ₳500k investment. At higher adoption levels, this protection extends to hundreds of millions of ADA in user transactions, compounding Cardano’s security and trust narrative and also increases Cardano's on-chain transactions by millions.

[Required Acknowledgements] Consent & Confirmation

Terms and Conditions:

Yes

Team

- Ritam Gupta | Co-Founder and CEO - 2x Founder with successful exits. Approx 10 years of experience in web3 space, leading a successful web3 development company with clientele including Dolce & Gabbana, The SandBox, Animoca Brands, Polygon, etc.

Heads strategy, business operations, executive responsibilities and investor relations.

LinkedIn : https://www.linkedin.com/in/ritamgupta

Based : Dubai, UAE

- Arhaam Patvi | Co-Founder and CTO - 7 years of web3 tech experience. Contributor to Hyperledger Indy Open Source Repositories; fullstack development experience on projects including The SandBox, SuperFarm, etc.

LinkedIn : https://www.linkedin.com/in/arhaampatvi

Based : India | UAE

- Daniela Flores Recillas | Actuarial Consultant - Half a decade of experience with Actuarial Sciences. Analyze information, identify root causes and provide suitable solutions to Insurance related problems.

LinkedIn : https://www.linkedin.com/in/daniela-flores-recillas-84ba9b13a

Based : Mexico | UAE

- Yusuf Goolamabbas | Advisor, Web3 - Chief Technology Officer at Animoca Brands. Have been an avid contributor to web3 and AI space.

LinkedIn : https://www.linkedin.com/in/yusufg

- Alberto Chierici | Advisor, Insurance - Ex-Tesla and Ex-Deloitte; Expert in Insurance Space

LinkedIn : https://www.linkedin.com/in/albertochierici

- Neeraj Gupta | Advisor, Insurance - CEO at PolicyBazaar UAE; Expert in Insurance and Insurance Broking