Last updated 2 months ago

Minswap Auto Trading Next-Gen Bot by Seerbot

Problem

Cardano traders lack on-chain tools for active asset growth. Self-trading is complex, while delegating to experts is risky due to a lack of transparent on-chain mechanisms.

Solution

We will build SeerBOT "Strategy Vault" - an auto trading bot based on technical analysis based on Cardano

About this idea

[Proposal setup] Proposal title

Please provide your proposal title

Minswap Auto Trading Next-Gen Bot by Seerbot

[Proposal Summary] Budget Information

Enter the amount of funding you are requesting in ADA

190000

[Proposal Summary] Time

Please specify how many months you expect your project to last

6

[Proposal Summary] Translation Information

Please indicate if your proposal has been auto-translated

Yes

Original Language

en

[Proposal Summary] Problem Statement

What is the problem you want to solve?

Cardano traders lack on-chain tools for active asset growth. Self-trading is complex, while delegating to experts is risky due to a lack of transparent on-chain mechanisms.

[Proposal Summary] Supporting Documentation

Supporting links

- https://www.seerbot.io ,

- https://www.canva.com/design/DAG5rORI7Hw/CZ5M4bm72e65whVoCHPysg/view?utm_content=DAG5rORI7Hw&utm_campaign=designshare&utm_medium=link2&utm_source=uniquelinks&utlId=hc9e7fc882b ,

- https://www.figma.com/proto/JeLOzvhuKoBAgCg2QZ0lds/SeerBOT---Design?page-id=0%3A1&node-id=221-7071&viewport=254%2C174%2C0.28&t=yjpITClMosKavcU3-1&scaling=min-zoom&content-scaling=fixed&starting-point-node-id=399%3A16411&show-proto-sidebar=1

[Proposal Summary] Project Dependencies

Does your project have any dependencies on other organizations, technical or otherwise?

No

Describe any dependencies or write 'No dependencies'

No dependencies

[Proposal Summary] Project Open Source

Will your project's outputs be fully open source?

Yes

Please provide details on the intellectual property (IP) status of your project outputs, including whether they will be released as open source or retained under another licence.

Apache 2.0 LICENSE

[Theme Selection] Theme

Please choose the most relevant theme and tag related to the outcomes of your proposal

DeFi

[Campaign Category] Category Questions

Describe what makes your idea innovative compared to what has been previously launched in the market (whether by you or others).

The Cardano ecosystem has long lacked sophisticated financial tooling, leaving users caught between modest staking rewards and complex LP farms that always carry the inherent risk of Impermanent Loss. SeerBOT was created to fill this void. Our innovation is a pioneering auto-trading model designed to meet the community’s most urgent need: generating yield on stablecoins without the complexity or risks of traditional farming.

Our Strategy Vault represents a breakthrough in accessibility and risk management. It is built for investors who believe in the power of Technical Analysis (TA) but lack the time or expertise to execute trades 24/7. We are the first on Cardano to package proven TA strategies into an automated, on-chain investment product. Crucially, this is a single-sided deposit model using USDM or ADA. The complexity of chart-watching is now simplified into a single action (depositing USDM or ADA) . This is the "set it and forget it" solution that finally makes professional-grade trading methods easily accessible to everyone.

Describe what your prototype or MVP will demonstrate, and where it can be accessed.

Our Minimum Viable Product (MVP) is engineered to validate the technical integrity and security of the Strategy Vault.

The MVP will demonstrate the entire lifecycle of an on-chain investment, focusing on smart contract robustness and reliability:

- Wallet Interaction & Discovery: It will validate seamless and stable connectivity with standard ecosystem wallets, beginning with Lace and Eternl. Users will interact with an intuitive interface displaying the available strategic Vaults.

- Smart Contract Execution: This is the core test. Users will successfully execute the two most critical transactions: a Deposit (using USDM) into the Vault's smart contract, and a Withdrawal of those assets back to their wallet.

- Proof Objective: This end-to-end flow will confirm that our smart contracts function with perfect financial logic, ensuring user assets are managed transparently, securely, and are always recoverable according to the defined rules.

The functional prototype will be deployed on the Cardano Pre-Production Testnet for rigorous community testing. It will be publicly accessible via the official SeerBOT dApp portal at: seerbot.io

Additionally, we have completed the full UI/UX design, which you can explore in detail via our Figma link

Describe realistic measures of success, ideally with on-chain metrics.

Our project's success will not be measured by speculative growth metrics or initial user interest. We define success through concrete, binary, and publicly verifiable deliverables. This is our firm commitment to project completion and functional delivery.

Mainnet Deployment and Public Access: The most critical measure of success is the full launch of the "Strategy Vault" on the Cardano Mainnet. The vault must be 100% operational in a live environment. Success is achieved when we provide a publicly accessible URL to the dApp, allowing anyone, including the Catalyst community and global users, to directly access and interact with the platform.

Verifiable On-Chain Transactional Proof: The platform must not just "exist"; it must function. Success will be measured by the platform's demonstrated ability to generate verifiable on-chain transactions on Mainnet. Specifically, this includes:

- Successful Deposit transactions of USDM into the Strategy Vault Smart Contracts.

- Successful Withdrawal transactions where users retrieve their principal and profits. These Mainnet transaction hashes will serve as irrefutable proof that our core financial workflows operate exactly as promised.

Security Audit Verification: Given the financial nature of the product, security is non-negotiable. Success is defined by the completion of a Smart Contract Audit. We must produce a final audit report confirming that there are zero critical or high-severity vulnerabilities remaining in the Vault's logic. This ensures the safety of user funds before mass adoption.

Comprehensive Video Verification: Finally, to ensure full transparency and verify usability, we will publish a comprehensive video demo. This video will be a screen recording of a real user interacting with the live Mainnet product. It will provide a step-by-step walkthrough of the entire user journey: connecting a wallet, depositing USDM into a Vault, and successfully withdrawing assets. This document will be the final proof that the product is complete, functional, and ready for all users.

[Your Project and Solution] Solution

Please describe your proposed solution and how it addresses the problem

Cardano's Critical Bottlenecks: The Yield Gap and the Automation Deadlock

An analysis of 2025 on-chain behavior reveals a major contradiction in the Cardano ecosystem. Data from Bitpanda Academy (2025) confirms that a vast majority, around 71.8% of the total circulating ADA, is being staked. This proves that Cardano users are security-conscious, long-term investors (HODLers) who prioritize stability. However, their yield options beyond staking are high-risk. Messari's Q3 2025 report (cited by KuCoin and MEXC) shows that traditional AMM DEXs dominate, with Minswap capturing 74.7% of trading volume. These platforms force users to accept the significant and ever-present risk of "Impermanent Loss" when providing liquidity. This creates a clear "yield gap," where the loyal majority of the community has no safe, passive investment tools that align with their philosophy.

- Bitpanda Academy (2025). Cardano forecast 2025: trends, scenarios and expert opinions. Retrieved from: https://www.bitpanda.com/en/academy/cardano-forecast-2025-trends-scenarios-and-expert-opinions

- KuCoin News (Nov 11, 2025). Cardano (ADA) DeFi TVL Hits 3-Year High. Retrieved from: https://www.kucoin.com/news/flash/cardano-ada-defi-tvl-hits-3-year-high-whales-buy-348m-tokens

For the active trader segment, the problem is a fundamental philosophical conflict. The global demand for automated trading is massive, with Coincub (2025) estimating, "Around 70% of the entire global trading volume is now handled by algorithms." On Cardano, however, traders have no viable options to automate their strategies on decentralized exchanges. Existing "Cardano Trading Bots," like those from Bitsgap (2025), are third-party services. Their documentation explicitly states: "...automate your ADA trading on Binance, Bybit, Kucoin... Connect your favorite exchange to our platform via an API key." This directly violates the community's core "Not your keys, not your coins" principle, creating a trust and security barrier that leaves on-chain traders unequipped.

- Coincub (2025). Are Crypto Trading Bots Worth It in 2025? Truth Behind Automated Trading. Retrieved from: https://coincub.com/are-crypto-trading-bots-worth-it-2025/

- Bitsgap (2025). Cardano Trading Bot | ADA. Retrieved from: https://bitsgap.com/crypto-trading-bot/cardano

The consequence of this lack of sophisticated execution tools is severe and costly. Traders forced to manually execute large swaps on DEXs face catastrophic slippage risk. A widely reported incident on November 17, 2025 (reported by CoinMarketCap and Decrypt) serves as a stark example: a single wallet executed a swap of 14.4 million ADA and instantly lost approximately $6 million in value due to 90% slippage in a low-liquidity pool. This incident is not an anomaly; it is a symptom of a systemic problem. The market fundamentally lacks the automated tools necessary to protect users from split-second volatility and market execution inefficiency.

- CoinMarketCap (Nov 17, 2025). Latest Cardano (ADA) Price Analysis. Retrieved from: https://coinmarketcap.com/cmc-ai/cardano/price-analysis/

- Decrypt (Nov 17, 2025). Cardano User's $6 Million Loss Exposes Risks in DeFi. Retrieved from: https://decrypt.co/news-explorer?pinned=1234116&title=cardano-users-6-million-loss-exposes-risks-in-defi

Proposed Solution: Bridging the Gap and Breaking the Deadlock

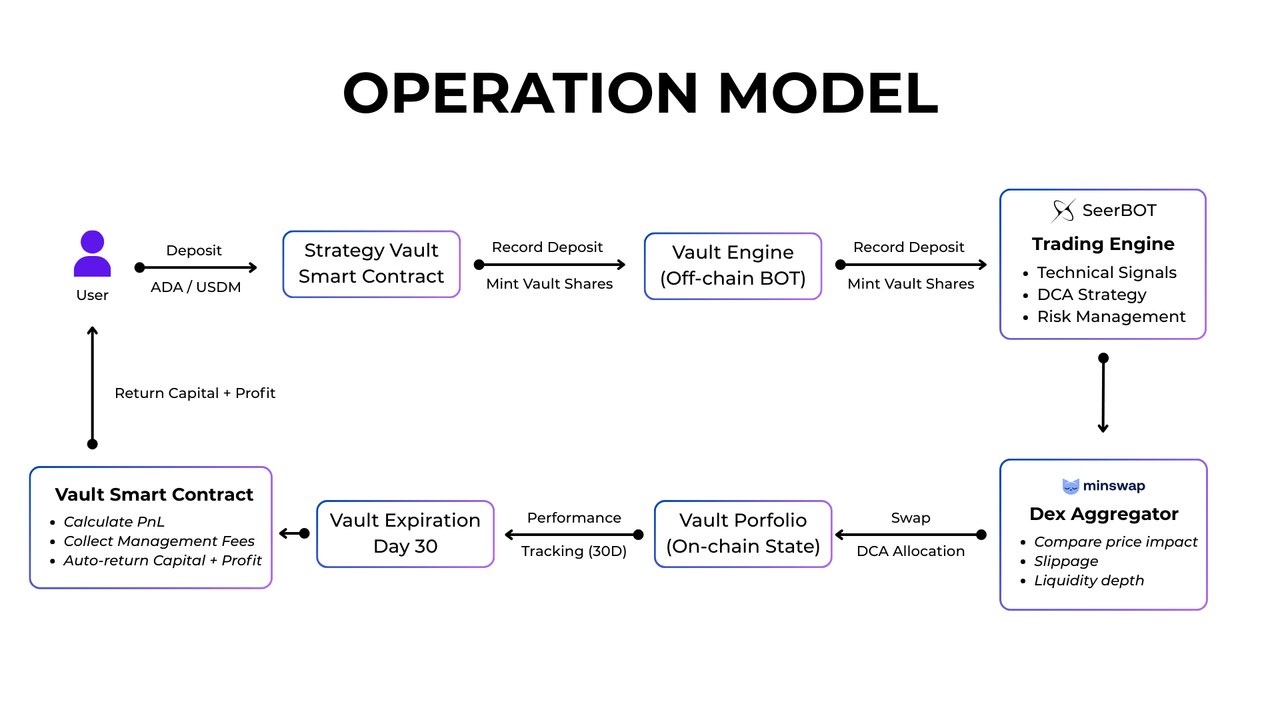

To directly address the "Yield Gap" and "Impermanent Loss" risks identified in our research, SeerBOT proposes the Strategy Vault—a secure, smart contract-based investment vehicle designed specifically for Cardano's eUTxO architecture.

The Core Innovation: How the Strategy Vault Works

Unlike simple non-custodial wallets, the Strategy Vault operates on a Hybrid Architecture, combining sophisticated Off-Chain computation with strict On-Chain Smart Contract custody.

- Smart Contract Custody & Tokenization (The "Vault")

- Mechanism: When users deposit assets (USDM or ADA), the funds are locked into a dedicated Plutus V2 Smart Contract.

- Proof of Ownership: Upon deposit, the Vault automatically mints and sends a "Vault Share Token" to the user's wallet. This token represents their proportional ownership of the pool and serves as the only key to redeem funds later.

- Algorithmic Execution & DCA Logic (The "Brain")

- Strategy: The SeerBOT Trading Engine operates off-chain, analyzing market data using backtested Technical Analysis signals (MA, RSI, Bollinger Bands, Supertrend) and internal price prediction models.

- Risk Management: Instead of "all-in" trades, the Bot executes a Dollar-Cost Averaging (DCA) strategy. Capital is allocated in chunks based on specific cycles (daily/48h) or price triggers to minimize volatility risk.

- On-Chain Execution via DEX Aggregator (The "Action")

- Smart Routing: When a trade is triggered, the Bot calls the API/SDK of leading DEXs like Minswap.

- Optimization: The engine utilizes Aggregator Logic to compare price impact, liquidity depth, and slippage, ensuring the best possible execution price.

- Transparency: Crucially, every swap is recorded on-chain, allowing users to audit the Vault's activity in real-time.

- Automated Settlement & Profit Distribution (The "Closure")

- 30-Day Cycle: The Vault operates on a fixed 30-day cycle. During this time, the Bot monitors performance and rebalances positions if market conditions turn adverse.

- Auto-Liquidation: At the end of Day 30, the Bot ceases trading and converts all accumulated assets back into the original token (ADA or USDM).

- Smart Contract Distribution: The Smart Contract automatically calculates Profit/Loss (P/L). It deducts the management fees (Note: We offer 0% fees for the first 6 months of 2026 to incentivize early adoption) and unlocks the total capital + profit.

- Redemption: Users burn their "Vault Share Token" to withdraw their final returns.

This architecture ensures that while the Bot manages the strategy, the Smart Contract governs the safety, ensuring funds are never withdrawn to unauthorized wallets.

[Your Project and Solution] Impact

Please define the positive impact your project will have on the wider Cardano community

Our project delivers 4 direct impacts that address liquidity retention, network usage, and ecosystem maturity:

- Retaining USDM Liquidity and TVL Currently, users often withdraw Stablecoins (USDM) from Cardano because there are few safe yield options.

- The Strategy Vault provides a secure, single-sided yield opportunity. This gives users a financial reason to keep their USDM locked within the Cardano ecosystem (Total Value Locked), rather than moving funds to centralized exchanges or other blockchains.

- Generating Consistent 24/7 Transaction Volume Human trading activity fluctuates and drops during off-hours.

- SeerBOT's algorithms trade automatically around the clock. This creates a predictable stream of real transaction volume and network fees for Stake Pool Operators (SPOs), ensuring the blockchain remains active regardless of market sentiment or time of day.

- Introducing Professional Asset Management Tools Cardano DeFi is currently limited to basic tools like Swaps and Lending.

- SeerBOT introduces "Structured Products" (automated investment vaults). This proves that the Cardano blockchain is capable of hosting complex, professional-grade financial applications, making the ecosystem more attractive to serious investors who require advanced tools.

- Increasing Volume for Existing DEXs SeerBOT does not compete with existing exchanges; we utilize them.

- Our Vaults route trade orders through Cardano’s leading DEXs (such as Minswap or Spectrum). As SeerBOT grows, we directly increase the trading volume and liquidity depth for these partner protocols, benefiting the entire DeFi infrastructure.

[Your Project and Solution] Capabilities & Feasibility

What is your capability to deliver your project with high levels of trust and accountability? How do you intend to validate if your approach is feasible?

Our team is built on a foundation of deep technical research. We have been engineering algorithmic trading strategies and automated execution systems since 2024, long before the current AI trend. The team consists of senior smart contract engineers and quantitative researchers who possess a rare combination of financial market acumen and low-level blockchain interaction skills. This deep historical foundation ensures that our auto-trading logic is built on years of R&D, prioritizing safety and efficiency above all else.

Proven Track Record (EVM Auto-Trading Deployment) Our capability to deliver high-stakes trading software is best demonstrated by our success on other chains. We have previously developed and deployed a fully functional Auto Trading Bot on EVM networks. This predecessor system successfully handled real-time order execution, liquidity management, and gas optimization under live market conditions. This tangible experience proves our ability to build secure, high-frequency trading logic that manages user funds responsibly.

Ecosystem Recognition & Accountability Within the Cardano ecosystem, our technical excellence has been verified by experts and the community. We were honored to receive an award at the Cardano Vietnam Hackathon 2025, a testament to our coding quality and innovation. Furthermore, as a successfully funded proposer in Project Catalyst Fund14, we have maintained a perfect track record of accountability. We are currently on schedule to launch the SeerBOT Web App in December 2025, demonstrating our ability to manage funds responsibly and deliver milestones on time.

Current Project Readiness (UI/UX Design Completed) To ensure this Auto Trading Bot proposal is feasible and tangible, we have already advanced beyond the concept phase. We have completed 100% of the UI/UX Design for the Bot Management Dashboard. Users can already visualize how they will configure strategies, deposit assets, and monitor bot performance. Unlike "black box" scripts, our bot has a user-friendly interface that is ready for implementation. The community is invited to inspect the detailed design via this Figma link: [FIGMA LINK HERE].

Methodology to Validate Feasibility

We employ a Dual-Validation Framework to ensure realistic feasibility before mass deployment:

- Technical Validation (Internal Mainnet Stress Test) We will conduct extensive stress testing directly on the Cardano Mainnet using internal funds. Success is defined by these realistic criteria:

- Transaction Reliability: Achieve a >95% success rate for valid Deposit and Withdrawal transactions interacting with the Strategy Vault Smart Contract. The system must demonstrate robust Error Handling for the remaining 5% (caused by network congestion), ensuring user funds never get stuck.

- Algorithmic Execution Speed: The Off-Chain Execution Engine must detect market signals and submit swap transactions to the Mainnet within <60 seconds. This threshold is optimized for Cardano’s average block time, ensuring effective execution against market volatility.

- Security: Zero Critical or High-severity bugs remaining in the Smart Contract logic before opening to public users.

- User Acceptance Testing (UAT) Leveraging our existing Project Catalyst Fund 14 community, we will conduct a Closed Beta Test.

Usability (Task Completion): >90% of beta testers must be able to independently complete the full user journey (Connect Wallet -> Deposit USDM -> Withdraw) without technical support.

User Satisfaction (CSAT): Achieve a minimum CSAT score of 4/5, specifically validating user trust in the Vault's transparency and the ease of the withdrawal process.

[Milestones] Project Milestones

Milestone Title

Backend & Front-End Code Development

Milestone Outputs

This phase is the core foundation, focused 100% on developing all source code and validating the algorithmic efficiency before direct deployment to the Mainnet.

- Completed Official Backtest Report, proving the positive net return of the Technical Analysis strategies for the Strategy Vault feature.

- Smart Contract Development: 100% completion of the source code for the Strategy Vault Smart Contract

- Backend Development: 100% completion of the Off-Chain Execution Engine Code (the bot that manages the Vault's trading logic).

- Front End Development: 100% completion of the User Interface code for the Strategy Vault dApp.

Acceptance Criteria

- Backtest Performance: The Backtest Report must demonstrate a positive net profit (greater than 0% Net Profit) across historical market data.

- Smart Contract Deploy Success: The Strategy Vault Smart Contract code must be internally approved by the technical team as 100% complete and ready for Mainnet deployment.

- Backend Complete: The Off-Chain Execution Engine codebase must be approved as complete and ready to integrate with the Smart Contract.

- Front End Complete: The entire Front End codebase must be finalized and ready for integration.

Evidence of Completion

- Official Backtest Report (with data and assumptions)

- Git Repository link containing all finalized source code.

- The address of the Strategy Vault Smart Contract.

Delivery Month

2

Cost

70000

Progress

30 %

Milestone Title

Smart Contract Audit and Full Integration

Milestone Outputs

This phase focuses on connecting all previously developed codebases, deploying the fully integrated application onto the Cardano Mainnet, and finish Audit process

- Audit of the Strategy Vault V0 Smart Contract and addressing of any issues found.

- Successful connection of the Front End Code with the Off-Chain Execution Engine and the Smart Contracts deployed on the Mainnet.

- Deployment of the Front End Code to hosting and provision of the public URL operating directly on the Cardano Mainnet.

- Verification that the wallet connection feature functions stably with major wallets (such as Lace Wallet, Eternl Wallet).

Acceptance Criteria

- Audit for the Strategy Vault V0 Smart Contract commences (Audit Report).

- Successful completion of the wallet connection Transaction via the interface.

- Successful completion of the first Deposit Transaction of USDM into the Strategy Vault Smart Contract on the Mainnet.

- The entire system must be structurally sound and free of critical errors when performing basic Transactions.

Evidence of Completion

- Public link to the Final Audit Report (PDF) hosted on the project repository or website.

- Public URL linking directly to the application running on the Mainnet.

- Transaction Identifier proving the first successful deposit into the Strategy Vault.

Delivery Month

4

Cost

50000

Progress

70 %

Milestone Title

Confirming Economic Impact and Operational Stability

Milestone Outputs

This phase focuses on system resilience and demonstrating the real-world economic impact of SeerBOT by achieving committed hard metrics with the initial user base.

- Maintain continuous 24/7 operation to serve the user community and actively monitor on-chain activity metrics on the Mainnet.

- Analyze Operational Data and feedback from the user community to manage incidents. Ensure all critical errors are addressed immediately to maintain the system's integrity and reliability.

- Operate support channels to address inquiries and ensure a non-disrupted user experience.

Acceptance Criteria

- Transaction Activity (Metrics of Economic Impact): Achieve a verified minimum of 2,000 on-chain Transactions generated by the Strategy Vault on the Mainnet.

- Volume Achieved: Achieve a total minimum Transaction Volume of 100,000 ADA successfully processed through SeerBOT’s Smart Contracts on the Mainnet.

- System Stability: The system must maintain a minimum uptime of 99% throughout the operational month, and all critical incidents must be resolved within 24 hours.

- Support Readiness: Support channels must be fully established and provide official responses to user inquiries within 6 business hours.

Evidence of Completion

- Official On-Chain Data Report: Provision of a detailed report citing public on-chain data, verifying the total transaction count and volume achieved.

- Incident Management Log: Detailed documentation recording all critical incidents encountered, the time of resolution, and implemented corrective measures.

Delivery Month

5

Cost

40000

Progress

90 %

Milestone Title

Final Reporting, Documentation, and Project Closure

Milestone Outputs

- Final Project Report: Completion of the comprehensive report for Project Catalyst, detailing the technical challenges overcome, lessons from Mainnet operation, and economic impact analysis (2,000 Transactions, 100,000 ADA Volume).

- Open Source Release: Preparation and public release of the entire Source Code (Smart Contract and Off-Chain Engine) under an open-source license to ensure transparency and community benefit.

- Public Assets: Finalization and release of the high-quality Official Video Demonstration and comprehensive User Guides specifically for the Strategy Vault.

Acceptance Criteria

- Project Completion: The project must achieve 100% of the functional objectives committed. The Strategy Vault must be fully operational, free of critical errors, and ready for daily use.

- Technology Handover: The entire Source Code must be publicly released and accessible.

- Visual Verification: The Official Video Demonstration must be unedited and clearly demonstrate the successful execution of the core workflows: Deposit USDM and Withdrawal from the Strategy Vault on Mainnet.

Evidence of Completion

- Final Project Report published.

- Public URL linking to the Open Source Code Repository (GitHub/GitLab).

- Link to the Official Video Demonstration.

Delivery Month

6

Cost

30000

Progress

100 %

[Final Pitch] Budget & Costs

Please provide a cost breakdown of the proposed work and resources

Project Budget and Cost Breakdown (Total: 140,000 ADA over 6 Months)

Milestone 1: 70.000 ADA

This milestone covers all core research and development. It includes running comprehensive Backtests on the Technical Analysis algorithms and developing 100% of the Smart Contract , Off-Chain Execution Engine, and Front-End source code.

Resource Allocation:

- Software Engineers (4): 1,200 total hours for writing core Smart Contract and Engine code.

- Front-End Engineer (1): 250 hours for final User Interface source code development.

- Project Manager (1): 100 hours for scope management and strategy documentation.

This allocation covers the high cost of Intellectual Property (IP) creation and eliminates core design risk by validating algorithmic feasibility before deployment.

Milestone 2: 50.000 ADA

The focus is on deploying all Smart Contracts to the Cardano Mainnet and executing the integration. Work includes writing deployment scripts, optimizing the Off-Chain Execution Engine for the live network, and conducting functional testing over the two-month period (Months 3–4).

Resource Allocation:

- Smart Contract and Backend Engineers (3): 600 total hours for phased Mainnet deployment, network optimization, and End-to-End integration.

- Quality Assurance Engineer (1): 150 hours for rigorous integration testing on the Mainnet environment.

- Project Manager (1): 50 hours for coordinating the Mainnet rollout.

- External Audit Fee: 12,500 - 20,000 ADA allocated for a third-party security audit firm.

This budget covers the highest-risk phase. The significant allocation for an External Audit ensures the safety of user funds, which is critical for a custodial Vault product.

Milestone 3: 40.000 ADA

This phase ensures system resilience during initial public usage. Activities include 24/7 Engine monitoring, managing incidents, supporting the community, and collecting the verifiable data required to meet the committed hard metrics.

Resource Allocation:

- Backend Operations Engineer (2): 100 hours for 24/7 monitoring and incident management.

- Community/Product Specialist (1): 150 hours for running support channels and operational data analysis.

This budget validates the project's economic viability by dedicating resources to achieving the required on-chain metrics (2,000 Transactions and 100,000 ADA Volume) and maintaining system stability under live load.

Milestone 4: 30.000 ADA

Closing the project by ensuring full accountability and technology handover. Work includes writing the Official Final Report.

Resource Allocation:

- Project Manager (1): 80hours for Official Final Report writing and data synthesis.

- Software Engineer (2): 90 hours for code cleanup, documentation, and preparing the open-source repository.

This guarantees the highest level of accountability to the community. Publicly releasing the open-source code ensures the long-term sustainability and allows external parties to verify security and code quality.

[Final Pitch] Value for Money

How does the cost of the project represent value for the Cardano ecosystem?

The proposed budget of 190,000 ADA represents significantly more than just the cost to develop a product; this investment brings forth perpetual multiplying value by solving the single biggest barrier to DeFi participation on Cardano: Impermanent Loss.

- Eliminating the "Liquidity Trap" and Open Source Multiplier

Currently, Cardano investors face a dilemma: either accept low yields from Staking or face high "Impermanent Loss" risks in Liquidity Pools. This structural gap forces capital to leave the ecosystem.

- The Solution Value: By funding the SeerBOT Strategy Vault, the community pays once to permanently introduce Single-Sided Yield technology. We remove the risk of Impermanent Loss, unlocking a massive amount of dormant capital that is currently afraid to enter DeFi.

- Open Source Multiplier: The source code of our Off-Chain Execution Engine and Vault Smart Contracts will be released as Open Source. This provides a technically validated framework for future developers to build their own Structured Financial Products without reinventing the wheel, saving thousands of development hours for the ecosystem.

- Creating "Sticky Liquidity" and Economic Retention

This project directly addresses the problem of capital flight.

- Retaining Capital: When users have no safe place to earn yield on stablecoins (USDM), they cash out. SeerBOT provides a "safe harbor," transforming transient capital into "Sticky Liquidity" that remains locked within the Cardano ecosystem (Total Value Locked), even during market downturns.

Verifiable Impact: The 190,000 ADA investment is directly tied to achieving hard, verifiable metrics on the Mainnet: 2,000 on-chain Transactions and 100,000 ADA Transaction Volume. This ensures the community gets immediate, proven economic activity in return for funding.

[Self-Assessment] Self-Assessment Checklist

I confirm that evidence of prior research, whitepaper, design, or proof-of-concept is provided.

Yes

I confirm that the proposal includes ecosystem research and uses the findings to either (a) justify its uniqueness over existing solutions or (b) demonstrate the value of its novel approach.

Yes

I confirm that the proposal demonstrates technical capability via verifiable in-house talent or a confirmed development partner (GitHub, LinkedIn, portfolio, etc.)

Yes

I confirm that the proposer and all team members are in good standing with prior Catalyst projects.

Yes

I confirm that the proposal clearly defines the problem and the value of the on-chain utility.

Yes

I confirm that the primary goal of the proposal is a working prototype deployed on at least a Cardano testnet.

Yes

I confirm that the proposal outlines a credible and clear technical plan and architecture.

Yes

I confirm that the budget and timeline (≤ 12 months) are realistic for the proposed work.

Yes

I confirm that the proposal includes a community engagement and feedback plan to amplify prototype adoption with the Cardano ecosystem.

Yes

I confirm that the budget is for future development only; excludes retroactive funding, incentives, giveaways, re-granting, or sub-treasuries.

Yes

[Required Acknowledgements] Consent & Confirmation

I Agree

Yes

Team

Barov [Marketing & BD] : Degen. Over 3 years in Web3 across marketing and BD roles in projects, incubators, and outsourcing—driven by a passion for building strong, value-focused communities.

- Email: justbarov@gmail.com

- Linkedin: https://www.linkedin.com/in/vibao3902/

Luke Nguyen [Backend, AI & Data] : OG trader. Experienced in AI & Data, , hands-on with infrastructure, logic, and algorithmic design for technical indicators and AI auto trading.

- Email: locduc1999@gmail.com

- Linkedin: https://www.linkedin.com/in/locnd99/

- Github: https://github.com/Ducloc1999

Heart Phung [Smart Contract] : Professional trader. 9 years in trading, 5 years in Web3. Also, a smart contract developer with hands-on experience building secure, efficient trading platforms across multiple chains.

- Email: thien.ite@gmail.com

- Linkedin: https://www.linkedin.com/in/thienphungvan/

- Github: https://github.com/phungvanthien

Loc La [Fullstack Developer] : Casual trader with a strong technical background, hands-on with multiple front-end and back-end frameworks, and experienced in building and scaling Web3 products.

- Email: nploc101999@gmail.com

- Github: https://github.com/nguyenPhuocLoc99

Armin Nguyen [Front-end] : New trader. Front-end developer with 2 years in Web3. Passionate about clean UI/UX and precision in execution.

- Email: anhoangbg@gmail.com

- Github: https://github.com/AnHoang12